Why U.S. Buyers Must Get HS Classification Right for Camping Furniture from China (Chapter 94 vs 63)?

If you’re importing camping furniture from China into the U.S., one detail can make or break your shipment—HS classification. I’ve seen how a simple mismatch between product design and customs coding can cause delays, unexpected duties, or even a full reclassification. That’s why I make it a point to clarify the classification early with every supplier and broker involved.

Why does HS classification matter when importing camping furniture from China?

Because it directly affects your duty rate, Section 301 exposure, and how fast your goods clear U.S. Customs.

If your folding chair is misclassified as a textile article instead of furniture, you could face higher tariffs and port delays. If your hammock has a stand but is treated like a soft sling, you might lose days or even weeks fixing the error. I’ve seen these cases play out—and the cost is more than just extra paperwork. It hits your margin, delays your delivery, and frustrates your customers.

That’s why understanding how U.S. Customs views Chapter 94 (furniture) vs Chapter 63 (textiles) is essential. It gives you control, lowers your risk, and lets you plan your landed cost with confidence.

Before you commit to a PO or begin mass production, you must make sure the entire team understands the HS classification logic. That includes your supplier in China, your QC team, your broker, and your logistics partners. You need to know what gives the product its essential character—its frame or its fabric—and you need documents that prove it. You also need your invoices, SKU data, packaging and wording to match that classification. If you do not build this alignment early, customs will make the decision for you at entry. That is the last place you want to discover a mismatch.

What is the quick rule of thumb for HS classification of camping furniture from China?

I often ask my team one simple question first: “Does the product get its identity from a rigid frame or from the textile?” This tiny question solves most classification problems in outdoor furniture.

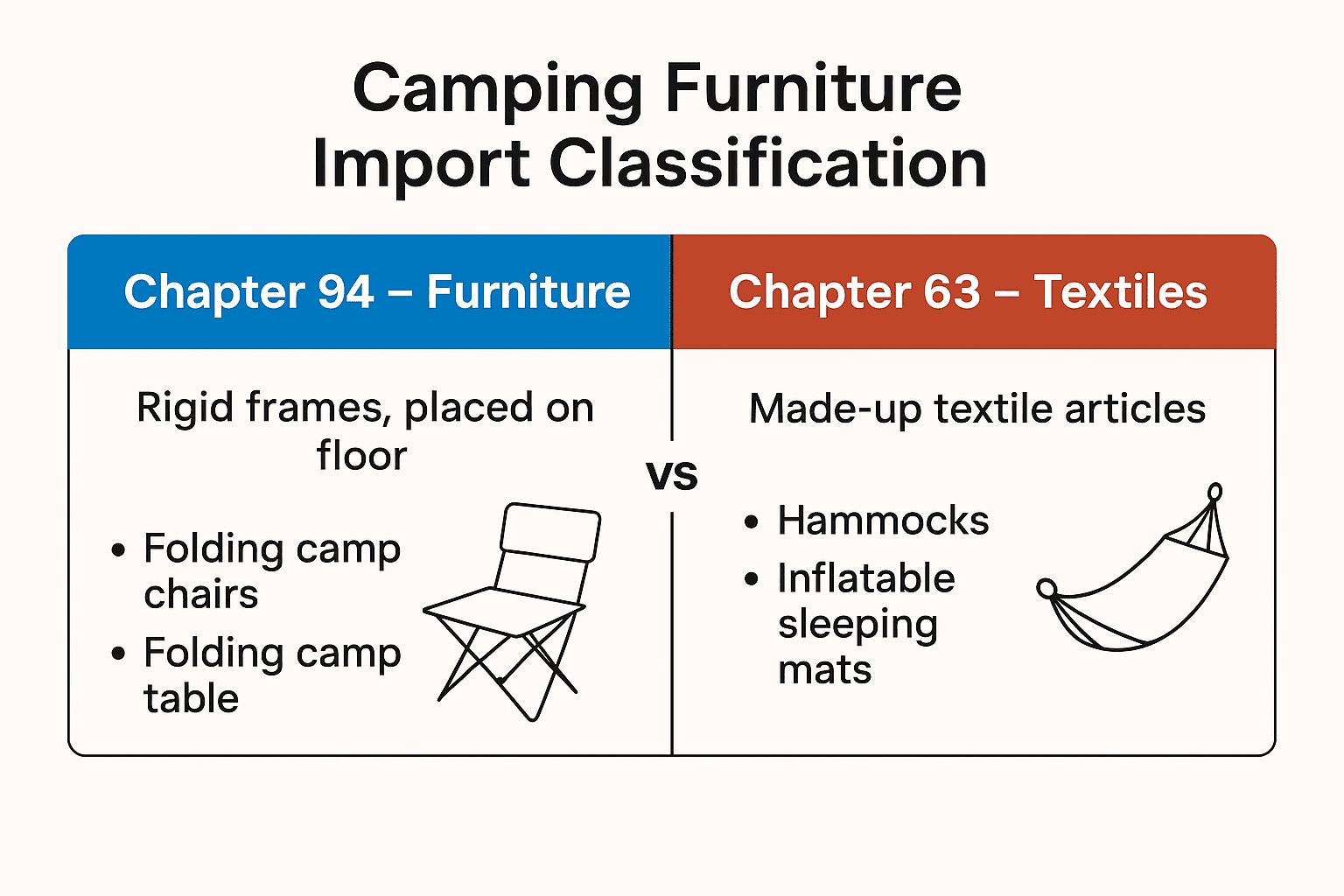

Chapter 94 – Furniture

Items with rigid frames meant to sit on the floor, support a person, or hold weight. Metal, aluminium or plastic legs give the product its character.

Chapter 63 – Textiles

Soft‑goods, covers, slings, tents and made‑up articles that rely on fabric—not a frame—for use and identity.

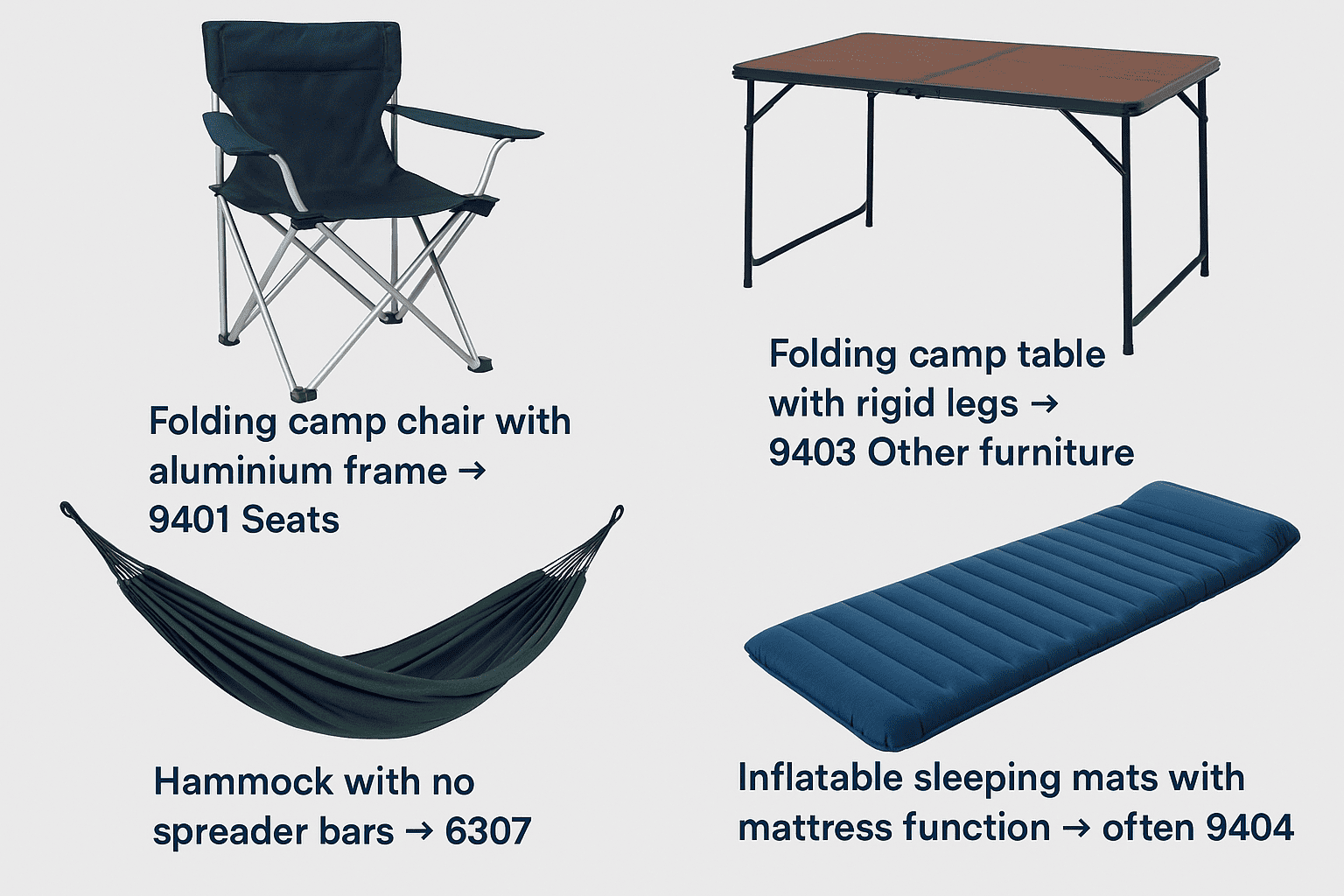

Examples

- Folding camp chair with aluminium frame → 9401 Seats

- Folding camp table with rigid legs → 9403 Other furniture

- Hammock with no spreader bars → 6307

- Inflatable sleeping mats with mattress function → often 9404

When I work with Chinese manufacturers, I always classify each SKU using this rule before we even reach PP approval.

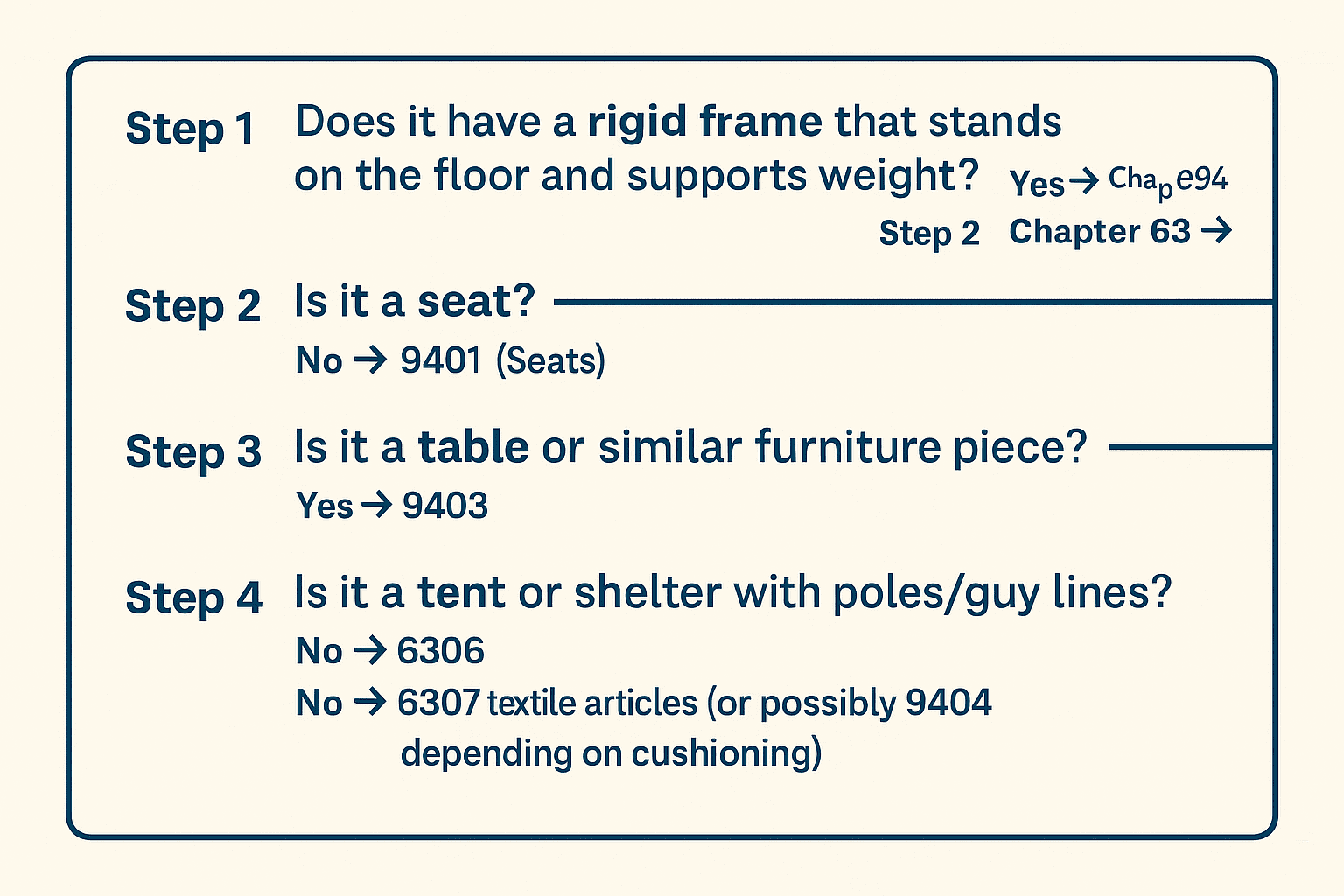

How to use the HS classification decision tree for camping furniture?

I use this decision tree in every onboarding meeting with suppliers and clients. It creates clarity fast:

Step 1: Does it have a rigid frame that stands on the floor and supports weight?

- Yes → Chapter 94 → Step 2

- No → Chapter 63 → Step 4

Step 2: Is it a seat?

- Yes → 9401 (Seats)

- No → Step 3

Step 3: Is it a table or similar furniture piece?

- Yes → 9403

- No → evaluate 9404 if mattress‑like.

Step 4: Is it a tent or shelter with poles/guy lines?

- Yes → 6306

- No → 6307 textile articles (or possibly 9404 depending on cushioning).

By applying this decision tree early, you avoid disputes later.

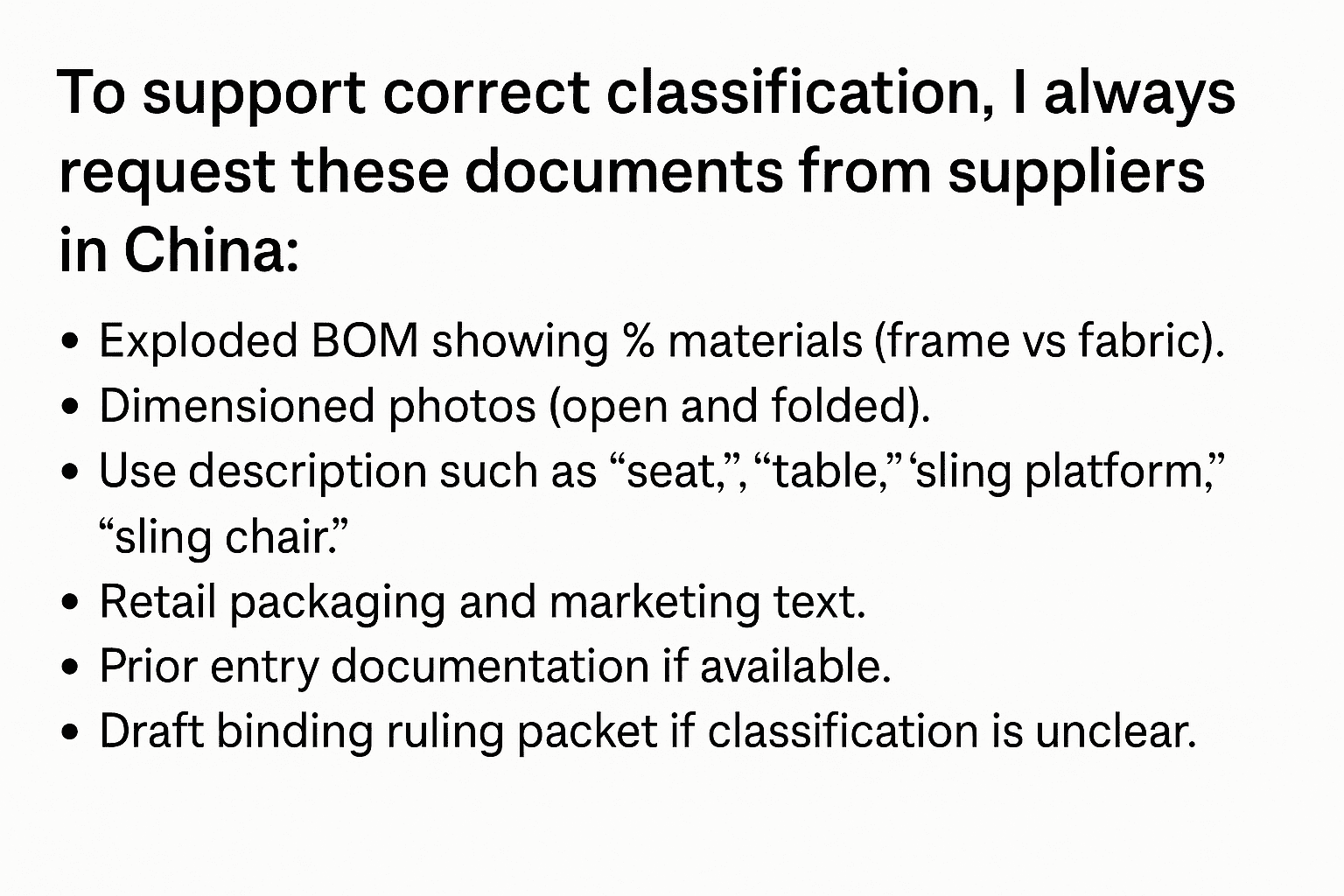

Why documentation matters and what to prepare for HS classification?

To support correct classification, I always request these documents from suppliers in China:

- Exploded BOM showing % materials (frame vs fabric).

- Dimensioned photos (open and folded).

- Use description such as “seat,” “table,” “sleep platform,” “sling chair.”

- Retail packaging and marketing text.

- Prior entry documentation if available.

- Draft binding ruling packet if classification is unclear.

With this documentation, customs has far fewer reasons to question an entry.

What buyer PO clauses help enforce HS classification discipline?

I always include these clauses in my buyer POs:

- HTS lock clause: Supplier must use the agreed HTS unless the buyer approves changes.

- Data alignment clause: Invoice, PL, and master data must match the HTS description.

- Evidence file clause: Supplier must provide BOM, photos and descriptions before PP approval.

- Ruling cooperation clause: Supplier must support any binding‑ruling request.

These clauses protect your classification decisions long before goods reach the port.

What is the buyer’s HS classification checklist before first shipment?

Use this checklist before your container leaves China:

- ✅ Decision tree applied; essential character documented

- ✅ HTS 10‑digit approved by broker

- ✅ Invoice/PL wording matches classification

- ✅ Binding‑ruling package ready if grey zone

- ✅ ISF/entry team aligned on HTS

- ✅ PIM/portal data updated and consistent

This checklist prevents most port‑entry problems.

FAQ — HS Classification for Camping Furniture from China

Q1: Can fabric seats on metal frames ever fall under Chapter 63?

Almost never. The frame makes the product a seat, so Chapter 94 applies.

Q2: Are all cots considered furniture?

Most elevated cots with legs fall under Chapter 94. Soft mats or bags fall elsewhere.

Q3: How are hammocks classified?

No spreader bars → 6307.

Frame or stand → more likely Chapter 94.

Q4: Does marketing text affect HS classification?

Yes. Calling a chair a “pad” can move it toward Chapter 63 unintentionally.

Q5: When should I request a binding ruling?

Whenever the item is new, high‑volume, or lives between Chapters 94 and 63.

Why this applies to camping furniture manufacturers in China

As founder of Kingray Industrial Company Limited, I’ve spent more than 15 years helping brands source outdoor furniture from China. Many U.S. B2B clients struggle with unclear classification, poor documentation, slow supplier communication and mismatched descriptions. We fix these problems with strong R&D, reliable QC, transparent pricing and consistent after‑sales support. We help you classify correctly, source confidently and avoid customs surprises.

Conclusion

Classification affects duty, compliance and your profit. Use the decision tree, collect documentation early and align every partner. This is the fastest way to import camping furniture from China without risk.

Need expert support? Visit www.kingrayscn.com or email Lisa Wang at marketing@kingrayscn.com to schedule a consultation.